Carbon Emission Credits Trading

Emission Credits Trading

Carbon emission credits trading is a market where companies and other organizations can buy or sell greenhouse gas (GHG) emissions reductions. The market is growing rapidly, driven by corporate net-zero goals and interest in meeting the Paris Agreement’s goal of limiting global warming to 1.5 degrees Celsius over preindustrial levels.

trade carbon credits emissions can be reduced in a variety of ways, including through technology, renewable energy development, and other environmental initiatives. However, a large proportion of GHG emissions still comes from industrial activity and the burning of fossil fuels. This has been a major cause of climate change, resulting in an estimated 3°C increase in global temperatures over the past century.

Several countries, including the European Union, are currently developing and operating emissions trading systems. These are designed to limit carbon dioxide emissions and require polluters to purchase permits – or allowances – in order to offset their emissions.

Carbon Emission Credits Trading

While ETS are widely regarded as effective in reducing GHG emissions, they have also been criticised for a number of shortcomings. One problem is that the free allocation of emissions permits has resulted in a glut of permits, which has pushed down the price and led to ineffective reductions in emissions. Another is that the trading of so-called offset permits – gained from paying for pollution reductions in poorer countries – can reduce the value of the overall cap and trade system.

These criticisms have led many environmentalists to argue that trading of carbon emissions is undermining the need for alternative approaches to reducing global CO2 emissions. For example, some believe that trading carbon credits is undermining the incentives for using renewable energy sources, which can be more effective in reducing CO2 emissions. Others argue that a carbon pricing scheme should be carefully structured so that it reflects the true cost of CO2 emissions.

Unlike compliance markets, voluntary carbon markets are open to all businesses and organizations that can demonstrate that they have significantly limited their GHG emissions by adopting certain practices or implementing new technologies. This allows for a more fluid approach to mitigating greenhouse gases than a rigid cap and trade scheme.

Voluntary carbon projects are usually certified by an independent organization called a standard, which sets forth specific methodologies and requirements for each type of project. These standards are used to assess the quality of GHG emissions reductions that can be achieved by an underlying project, and thus determine the price that will be paid for those credits on the voluntary market.

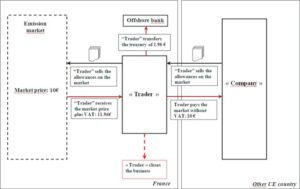

The market has a number of different players, including project developers, NGOs, and governments. In addition, a fifth player is the carbon trader, who purchases and markets credits on behalf of an end buyer. A carbon trader can buy and sell credits in both the forward and spot markets, and is typically a financial service provider that deals with regulated entities. These traders are often partnered with brokers that help them market and settle transactions.

Leave a Reply